[ad_1]

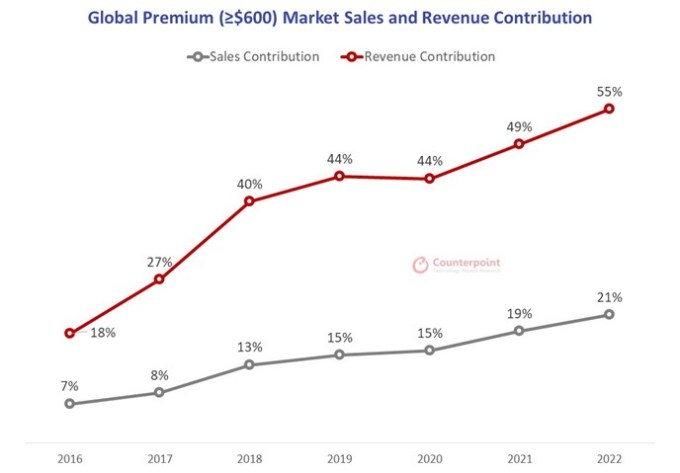

Amid the declining smartphone market, premium devices are having their moment. These pricy devices made up more than half of the worldwide smartphone market’s revenue, according to a report from Counterpoint.

The analytics company’s report says that premium devices (with a wholesale value of $600 or more) grew by 1% year-on-year in terms of shipment and captured 55% in terms of revenue. This is significant given the smartphone market showed a dip of 11% year-on-year for 2022 due to tough economic conditions.

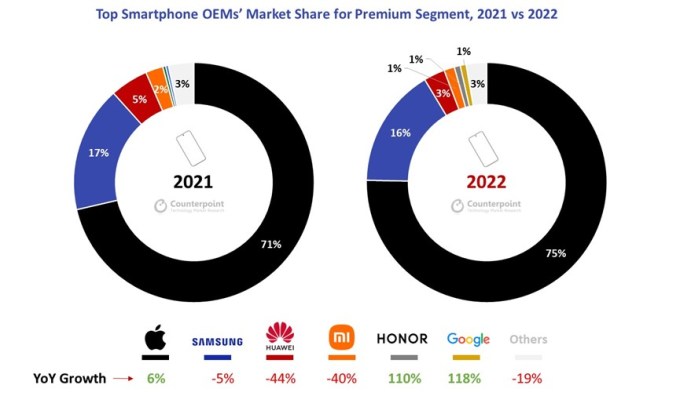

There is no prize for guessing the absolute winner of this market: Apple. The company had a mammoth 75% market share in the premium segment — sales grew by 6% year over year. Counterpoint mentioned that this growth would have been bigger if Apple didn’t face supply constraints for the iPhone 14 Pro and Pro Max.

A graph on revenue share and market sales share of premium smartphones Image Credits: Counterpoint

The Cupertino-based company also benefitted from Huawei’s decline in China, the report said. However, Honor — which spun off from Huawei — registered notable growth with its Magic series in China. The brand has global ambitions this year and recently launched flagship devices including a foldable at the Mobile World Congress (MWC) held in Barcelona.

While both Honor and Google grew more than 100% in the last year, their overall contribution to the market remains around 1%. So they are still significantly smaller players in the bigger picture. Other companies like Samsung and Xiaomi registered a decline in sales of 5% and 44% respectively. However, the analytics firm mentioned that foldable — which will supposedly grow by 52% this year — remains a bright spot for Samsung.

Image Credits: Counterpoint

Counterpoint analyst Varun Mishra said that people buying premium smartphones were willing to pay extra for the longevity of a device and better features. He also mentioned that because of that segment with phones above $1,000 grew 38% year-on-year.

“Despite the tough market conditions in 2022, affluent consumers were more immune to the macroeconomic difficulties than customers from the lower end. Consequently, sales in the premium market grew, while those in the entry and mid-tier segments declined. Also, as smartphones become more central to their lives, people are ready to spend more on their devices and retain them for a longer period,” he said.

Notably, users in developing markets also keep upgrading to a premium smartphone — especially folks who are on their third or fourth device. Companies like Apple, which primarily operates in the premium segment, have turned their focus on markets like India. Recently, Bloomberg reported that the company has made India a separate sales region.

While Apple (and by proxy iOS) enjoys a comfortable majority in the premium segment, the launch of foldable devices this year can give Android an opportunity to claw back some market share. On the other hand, analysts think that Apple will increase the price of Pro models launching this year giving the company an edge in terms of revenue.

[ad_2]